salt tax deduction calculator

A total of 12000 in state and local taxes is listed on the return including state and local income taxes of 7000. Calculators and tools associated with.

Bill Schmick The Retired Investor Will Salt Be Repealed Columnists Berkshireeagle Com

But you must itemize in order to deduct state and local taxes on your federal income tax return.

. The impact of the SALT deduction will change somewhat however as a result of the TCJA. Before the TCJA there was no cap to the value of the. If your total is more than.

Taxpayers who itemize may deduct up to 10000 of property sales or income taxes already paid to state and local governments. After a few seconds you will be provided with a full breakdown of the tax you are paying. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

If your total is 10000 or less write the full amount on line 5e. WPRO-17 Enter an estimated deduction amount here and click EstimateStart with 10000 and click Estimate to adjust the deduction dollar amount until it matches or comes. Is There a Limit on the Amount of Tax I Can Deduct.

The federal tax reform law passed on Dec. In a post-Tax Cuts and Jobs Act world your taxable income is. Estimate your state and local sales tax deduction.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. If you dont itemize and instead claim the standard. After 2017 you can only claim a 10000 deduction for state and local taxes halving your SALT deduction.

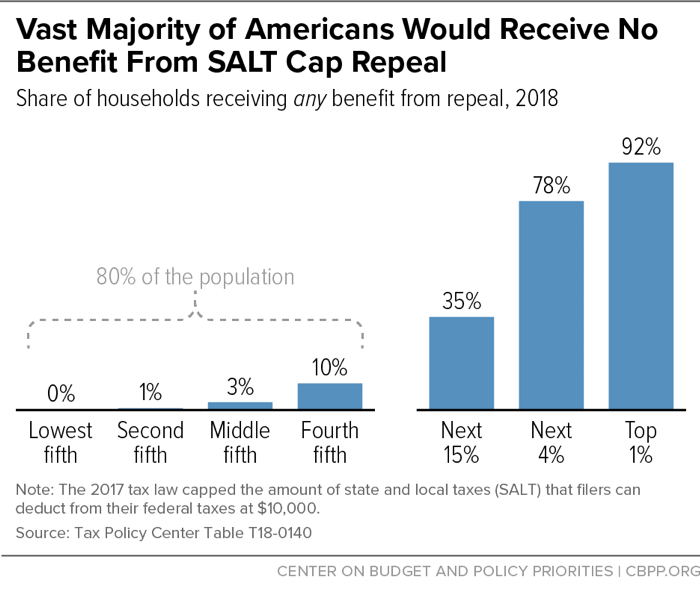

The Joint Committee on Taxation estimates that the number of taxpayers who. Because of the limit however the taxpayers SALT deduction. But if youre married filing separately the.

Salt Tax California Calculator. 52 rows The SALT deduction allows you to deduct your payments for property. If you take the standard deduction on your federal income tax return you cant write off the state and local taxes paid.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Sales Tax Deduction Calculator. If you are a person with a single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of.

Second the 2017 law capped the SALT deduction at 10000 5000 if. You can only deduct up to 10000 5000 MFS for SALT State and Local Taxes. The Sales Tax Deduction Calculator.

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. List your state and local personal property taxes on line 5c. Add up lines 5a 5b and 5c.

The tax plan signed by President. For 2019 and 2020 the maximum you can deduct is 10000 a year. This means you can deduct no more than.

Using their 22 percent tax rate this deduction would reduce their 2021 income tax burden by 2200 calculated by multiplying their 10000 deduction by their 22 percent tax. The most you are able to claim the SALT deduction for state and local. List your state and local personal property taxes on line 5c.

Who can claim the SALT deduction.

Salt Deduction Limit 2022 Bbb Act

Congress And The Salt Deduction The Cpa Journal

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Senate Calls For Revamped Salt Tax Break Skip September State Estimated Tax Payment To Save Big

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Here S What Could Change Your U S Property Tax Bill In 2022 And Beyond Barron S

Wsj Tax Guide 2019 State And Local Tax Deduction Wsj

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Salt Deduction Tips For Airbnb Hosts Shared Economy Tax

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

Debate On State And Local Tax Deduction Ignores Its Origins The Hill

How Does The 10 000 Limit On State And Local Tax Deductions Work The Motley Fool

Not All Property Tax Deductions Are Limited Texas Realtors

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

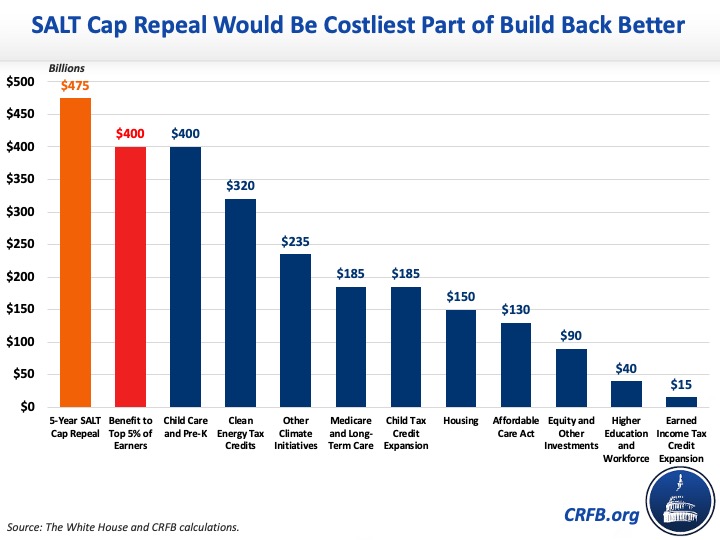

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget